More Pensioners Paying Tax

After decades of paying into their pension - More people over 65 are paying tax on their income than ever before.

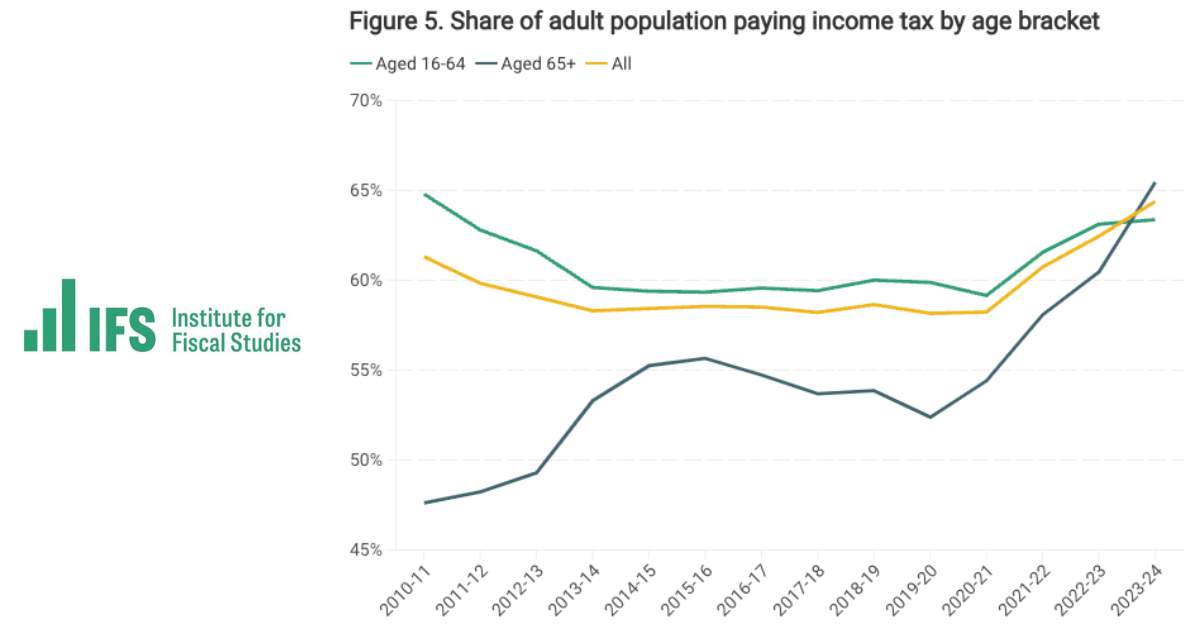

Two-thirds of pensioners are now subject to income tax. The first time in history those aged 65 and over are more likely to pay income tax than those aged 16 to 64.

This significant shift was detailed in a report by the Institute of Fiscal Studies (IFS).

Historically, older adults benefited from a higher personal allowance, which reduced the number of them paying income tax.

During the 2010s, personal allowance increases led to a decrease in the proportion of taxed adults from 58% to a lower figure.

However, this trend reversed in the 2020s when personal allowances decreased.

The rise in pensioners paying income tax is driven largely by more retirees drawing income above the lower 2020 tax threshold.

THE TRIPLE LOCK SYSTEM

This system ensures that the state pension increases annually by the highest number between inflation, average earnings growth, or 2.5%.

Despite this, the freeze on personal allowance means that a pensioner receiving the full state pension of £11,500 annually, along with some private pension, will be taxed.

By the financial year 2023-24, 65% of those aged 65 and over were paying income tax, up from 48% in 2010-11.

The Conservative Party has proposed a "triple lock plus" policy, which would adjust the tax-free personal allowance for pensioners according to the highest figure among inflation, earnings, or 2.5%.

They estimate this would boost the average state pension by £428 next year, and by £1,577 by the end of the parliament.

Moreover, broader fiscal policy changes and economic factors have led to income tax's share of national income rising from 9.4% in 2010 to a projected 11.3% by 2028-29.

The switch from the Retail Price Index (RPI) to the Consumer Price Index (CPI) for inflation measurement and tax rate adjustments significantly impacts tax revenue, as CPI inflation typically registers lower than RPI.

This results in smaller annual increases in tax thresholds, leading to higher tax revenues over the long term.